Cancel for Any Reason (CFAR),

a game changer for travel & hospitality

Give your customers unmatched flexibility when they book - no proof needed, no stress - just the power to cancel on their terms. CFAR can be offered as an add-on through any booking platform or included in booking rates, bank cards or mobile plan subscriptions, providing travelers with peace of mind. This cover is used by travel and hospitality businesses and platforms around the world to enhance their competitiveness, boost revenue and early bookings, and reduce the risk of last-minute cancellations.

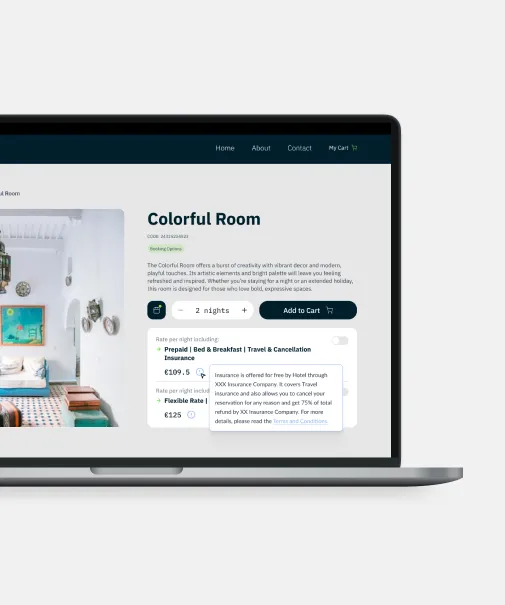

Tailored insurance coverages at the point of sale

Create new revenue streams by offering booking cancellation and travel insurance as add-ons when customers make a booking. Enable travelers to add the protection they need right when they book, reducing hesitation and increasing conversions. This is a perfect fit for hotels, airlines, booking engines, OTAs, B2B travel agency platforms, TMCs, ferries, and car rentals.

Cancellation Insurance embedded into the room rate

Include cancellation insurance in your prepaid bookings to give your customers the confidence to book well in advance and prepay, knowing they’re covered if their plans change. Boost early bookings, secure your revenue and cash flow, all while increasing direct bookings on your website. Choose from a variety of flexible coverages (Cancel for Any Reason, Cancel for a Specific Reason, and Travel Insurance) to suit every traveler’s needs. Trusted by leading hotel chains worldwide, this novel approach is setting a new standard in the hospitality industry.

CFAR as a B2B coverage for travel & hospitality businesses

Cancel for Any Reason can serve as a powerful B2B coverage, whether your business is a hotel, airline, car rental, travel wholesaler or bed bank, securing your revenue and cashflow while protecting your business from last-minute cancellations. If you operate a B2B travel-tech platform like a booking engine, channel manager, PMS, or revenue management system, CFAR is a unique offering for your B2B clients that strengthens your value proposition and sets you apart from competition.

Readily available insurance products

designed to meet every traveler’s needs

Plug & play solution, minimal effort,

zero cost & risk

Wallbid, a global insurtech provider, blends cutting-edge technology with innovative insurance products to deliver end-to-end solutions for partners around the world. We enable our partners to launch innovative insurance offerings in just weeks, eliminating insurance-related hassle and delays.

Zero cost solution for your business.

Innovative insurance products, underwritten by tier-1 reinsurers and insurers.

High-tech platform - seamless API integration.

Fully digital customer experience from buying a policy to filing a claim.

Web portal for real-time monitoring of sales and KPIs.