Enrich your services

with micro-insurance products

At Wallbid, we design and deliver smart, embedded insurance solutions that protect what matters most, while they are easily integrated into your everyday experiences. Our portfolio is built to meet the evolving needs of modern businesses and end customers, while unlocking new revenue opportunities through every digital touchpoint.

Our offerings are sourced from tier-1 global reinsurers, ensuring high-quality coverage and competitive pricing for partners across industries. Every product is tailored to fit local regulatory requirements and market-specific needs.

Booking Cancellation

Screen X-Ray

Extended Warranty

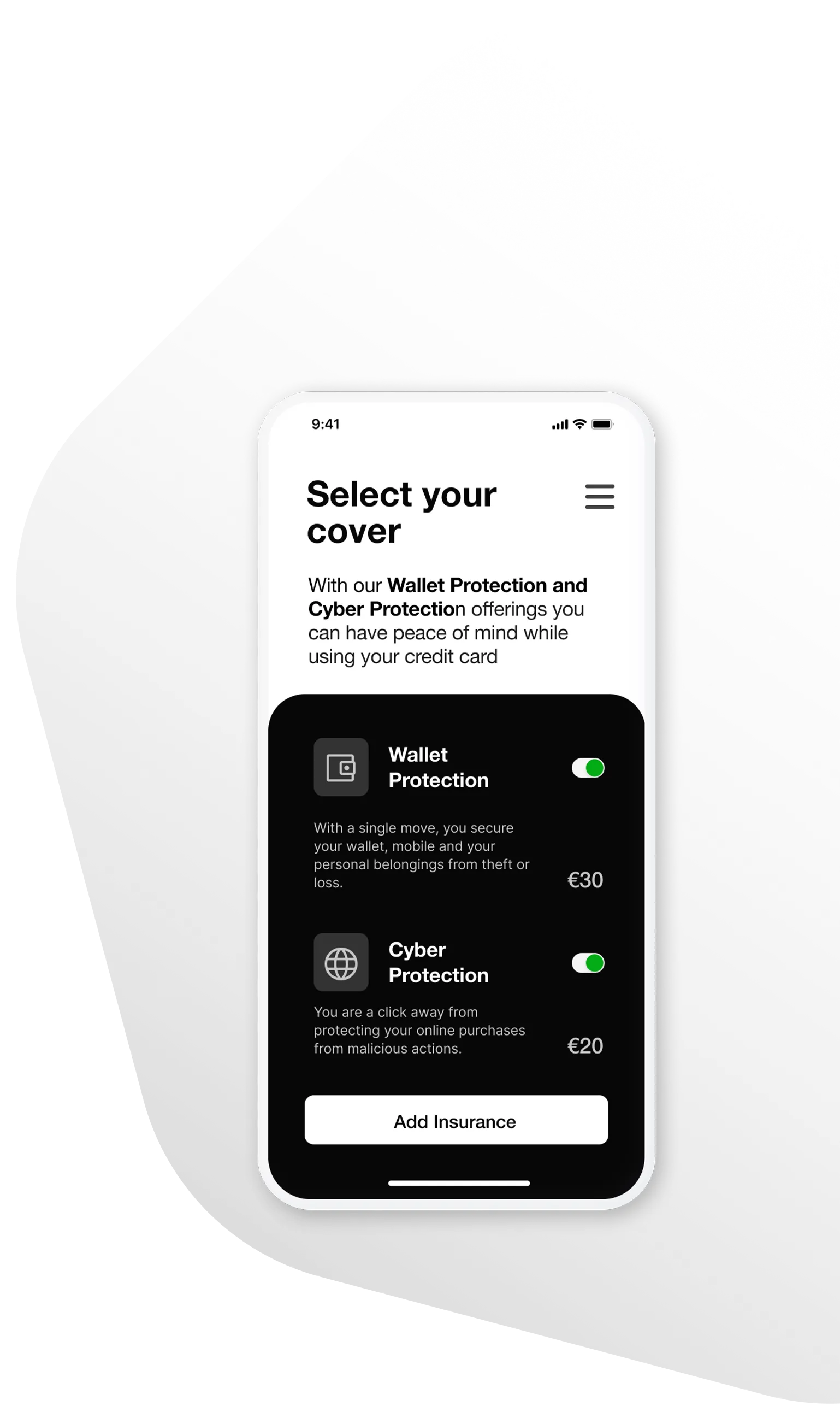

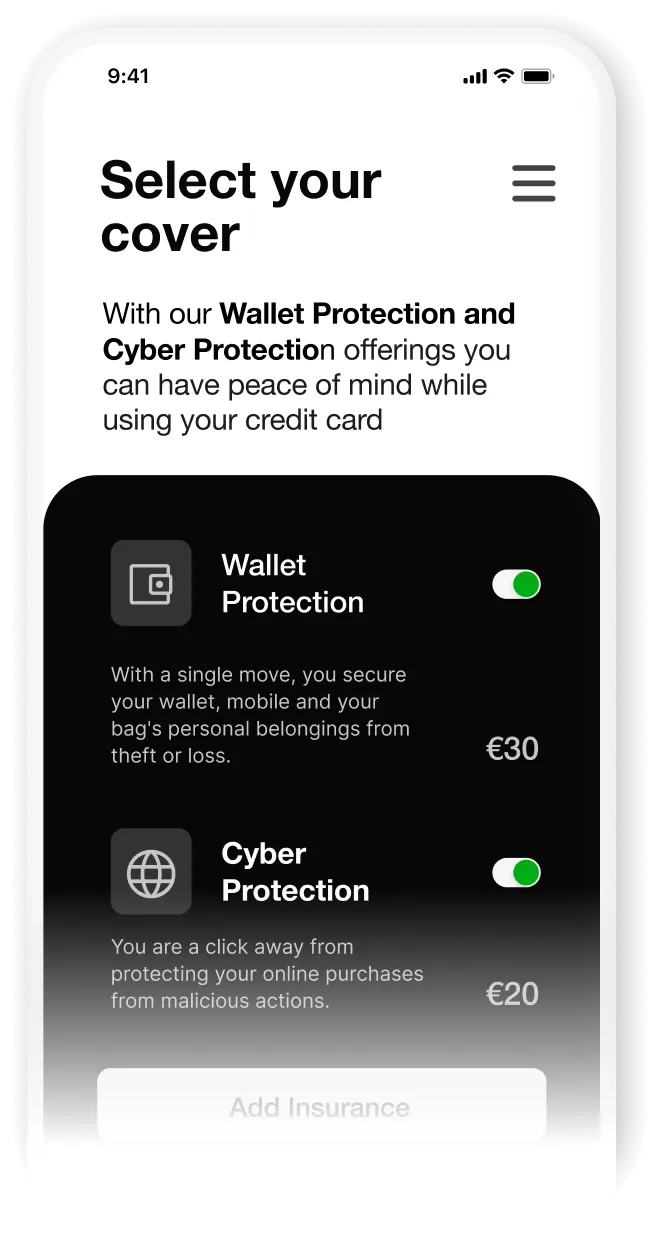

Cyber Protection

In the digital era, cyber threats are evolving faster than ever, putting individuals and businesses at constant risk of financial losses and disruptions to everyday life and operations. Our specialized B2C and B2B cyber protection solutions are designed to protect your customers and partners from emerging cyber risks.

Ticket Cancellation

Reimburses customers for non-refundable event ticket costs when they’re unable to attend due to documented reasons such as illness, accident, or other covered events. Can be offered as an optional add-on or embedded benefit through ticketing platforms, banks, telcos, and digital wallets.

Credit Protection

Helps customers stay on top of loan or credit repayments during difficult times, such as involuntary unemployment, disability, or critical illness. A high-impact add-on for banks, fintechs, and digital wallets, driving both value and retention.

Payment Protection Insurance (PPI)

Protects borrowers by covering outstanding loan or credit card repayments in the event of life-altering circumstances, including loss of life, permanent disability, or job loss. Seamlessly embedded into lending journeys by banks and financial institutions.

Bill Protection

Provides one-time financial support for utility or telecom bills in case of income loss due to illness, injury, or redundancy—ensuring continuity of essential services during challenging times.

Wallet Protection

Covers unauthorized transactions and personal item losses (including ID documents, keys, wallets, and phones) that occur in the event of theft or card loss. Often included as a premium loyalty benefit within banking or telco product bundles.

Buyer Protection

Secures online shoppers against common purchase issues such as missing, incorrect, or damaged items—enhancing trust and confidence in e-commerce transactions.

Home Contents Protection

Covers household belongings—like furniture, electronics, and appliances—against loss or damage due to fire, weather events, theft, or water leakage. Ideal for integration with smart home platforms, utility services, or telco offerings.

Medical Outpatient Insurance

Grants access to everyday healthcare services, including doctor visits, lab tests, diagnostics, and physiotherapy—offered through digital clinics, employer wellness programs, and fintech apps.

POS Insurance for SMEs

Protects retail businesses from income loss due to disruption caused by events like fire, flooding, strikes, or vandalism. The coverage reimburses lost revenue processed via POS terminals, making it an ideal safeguard for shops, cafés, and restaurants.

Auto Insurance

A fully digital insurance solution covering third-party liabilities, theft, fire, and physical damage. Designed for individual drivers, gig economy fleets, OEMs, and mobility marketplaces—enabling fast, embedded distribution.

Extended Auto Warranty

Protects car owners from unexpected repair costs after the manufacturer’s warranty expires. Includes coverage for mechanical and electrical breakdowns and can be offered at point-of-sale or post-sale via dealerships, inspection centers, automakers, and mobility platforms.